As another signal of an improving U.S. economy, the nation’s biggest banks have started to loosen mortgage lending guidelines.

As another signal of an improving U.S. economy, the nation’s biggest banks have started to loosen mortgage lending guidelines.

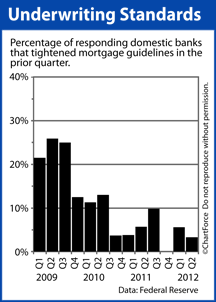

As reported by the Federal Reserve, last quarter, no “big banks” reported stricter mortgage standards as compared to the quarter prior and “modest fractions” of banks reported easier mortgage standards.

The data comes from the Fed’s quarterly Senior Loan Officer Survey, a questionnaire sent to 64 domestic banks and 23 U.S. branches of foreign banks. The survey is meant to gauge, among other things, direct demand for consumer loans and banks’ willingness to meet this demand.

Not surprisingly, as mortgage rates fell to all-time lows last quarter, nearly all responding banks reported an increase in demand for prime residential mortgages where “prime residential mortgage” is defined as a mortgage for an applicant whose credit scores are high; whose payment history is unblemished; and, whose debt-to-income ratios are low.

Consumers were eager to buy homes and/or refinance them last quarter and 6% of the nation’s big banks said their credit standards “eased somewhat” during that time frame. The remaining 94% of big banks said standards were left unchanged.

The ease of getting approved for a home loan, however, is relative.

As compared to 5 years ago, Minneapolis home buyers and rate shoppers face a distinctly more challenging mortgage environment. Not only are today’s minimum FICO score requirements higher by up to 100 points, depending on the loan product, applicants face new income scrutiny and must also demonstrate a more clear capacity to make repayments.

Tougher lending standards are among the reasons why the national home ownership rate is at its lowest point since 1997. It is harder to get mortgage-approved today as compared to late-last decade.

For those who apply and succeed, the reward is access to the lowest mortgage rates in a lifetime. Mortgage rates throughout Illinois continue to push home affordability to all-time highs.

If you’ve been shopping for a home, or planning to refinance, with mortgage rates low, it’s a good time to commit.