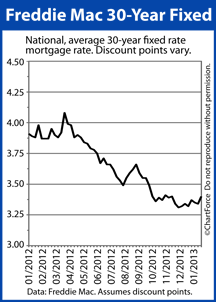

A quiet past week in economic news caused mortgage rates to worsen slightly.

A quiet past week in economic news caused mortgage rates to worsen slightly.

This week, however, will be packed with economic reports which may have an impact on interest rates going forward.

Freddie Mac reported that the average rate for a 30-year fixed rate mortgage rose by 3 basis points from 3.53 percent to 3.56 percent with borrowers paying 0.8 in discount points and all of their closing costs.

The average rate for a 15-year fixed rate mortgage was unchanged from last week at 2.77 percent with borrowers paying 0.8 in discount points and all of their closing costs.

In other economic news, the Consumer Price Index (CPI) for January fell slightly to 0.0 percent as compared to Wall Street expectations of 0.1 percent and December’s reading of 0.1 percent.

The Core CPI, which measures consumer prices exclusive of volatile food and energy sectors, was 0.3 percent for January and surpassed analyst expectations of 0.2 percent and December’s reading of 0.1 percent.

Inflation Remains Low

These readings remain well below the 2.5 percent inflation level cited by the Fed as cause for concern.

According to the Department of Commerce, Housing Starts for January fell to 890,000 from December’s 954,000 and below Wall Street projections of 910,000.

These seasonally adjusted and annualized numbers are obtained from a sample of 844 builders selected from 17,000 newly permitted building sites.

Falling construction rates could further affect low supplies of homes reported in some areas; as demand for homes increase, home prices and mortgage rates can be expected to rise.

Full Economic Calendar This Week

This week’s economic news schedule is full; Treasury auctions are scheduled for Monday, Tuesday and Wednesday. New Home Sales will be released Tuesday.

Fed Chairman Ben Bernanke is set to testify before Congress on Tuesday and Wednesday.

Wednesday’s news includes the Pending Home Sales Index and Durable Orders.

Thursday’s news includes the preliminary GDP report for Q4 2012, the Chicago Purchasing Managers Index, and weekly jobless claims.

Friday brings Personal Income and Core Personal Expenditures (CPE).

Consumer Sentiment, the ISM Index and Construction Spending round out the week’s economic news.

Mortgage rates rose last week nationwide during a week of sparse economic news.

Mortgage rates rose last week nationwide during a week of sparse economic news.