Home value rose to close out the summer, according to the S&P/Case-Shiller Index, a national home-valuation tracker.

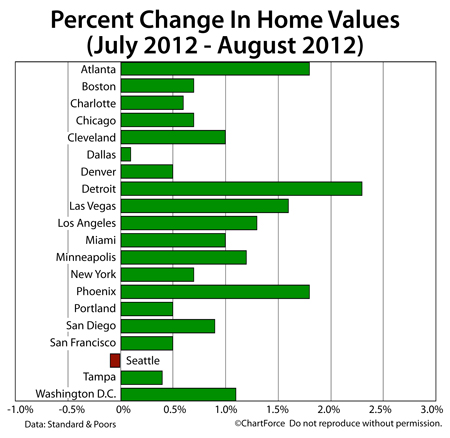

Nationwide, values rose 0.9% between July and August 2012 with 19 of 20 tracked markets showing improvement. Only one tracked city — Seattle, Washington — showed a decrease, falling just 0.1 percent.

On an annual basis, 17 of the 20 Case-Shiller Index markets improved, led by Phoenix. Home values in the Arizona city are up 18.8 percent from August 2011. The next closest city in terms of home price gains is Detroit, Michigan at 7.6 percent

We should temper our excitement for the August Case-Shiller Index, however. Although it suggests an ongoing U.S. housing recovery, the methodology of the Case-Shiller Index is far-from-perfect. In fact, one could argue that the index is more effective for policy-makers than for actual buyers and sellers of real estate.

There are three reasons for this :

- The Case-Shiller Index tracks home prices of single-family homes only. Multi-unit homes are excluded.

- The Case-Shiller Index can be distorted by “discounted” home sales (e.g.; foreclosure, short sale).

- The Case-Shiller Index publishes on a two-month delay — data is hardly current.

Beyond the above three points, however, the Case-Shiller Index falls short in another area — it ignores the basic tenet of housing that “all real estate is local”. In using 20 cities to represent the entire United States, the Case-Shiller Index reduces more than 3,100 municipalities into a single “market”.

Even within its 20 tracked cities, the Case-Shiller Index fails short as a housing market barometer. This is because — even with cities — home values vary. Some Minneapolis zip codes perform better than others, for example, as do some streets. The Case-Shiller Index can’t capture markets with that level of detail.

National housing data helps in spotting broader trends of growth but provides very little for today’s active buyers and sellers of real estate who need “real-time” data. For that, talk to a local real estate agent.