The number of U.S. housing markets showing “measurable and sustained growth” has increased by 19 this month, according to the National Association of Homebuilders’ Improving Market Index.

The number of U.S. housing markets showing “measurable and sustained growth” has increased by 19 this month, according to the National Association of Homebuilders’ Improving Market Index.

The Improving Market Index is a monthly report meant to identify U.S. markets in which economic growth is occurring broadly — not just in terms of home prices.

The IMI’s conclusions are based on three separately-collected data series, each from a different division of the U.S. government and each tied to specific local economic conditions.

In this way, the Improving Market Index gives a better idea of which markets will outperform averages in the months and years ahead.

The three data series incorporated into the Improving Market Index are :

- Employment Statistics (from the Bureau of Labor Statistics)

- Home Price Growth (from Freddie Mac)

- Single-Family Housing Growth (from the Census Bureau)

The National Association of Homebuilders evaluate the reports for each major metropolitan area and then deems a given one “improving” if two conditions are met. First, all three data series must indicate growth in the current month and, second, at least 6 months have passed since each of the data points’ respective “bottoms”.

The IMI ignore short-term spurts, in other words, and attempts to identify those areas showing long-term, sustainable growth. For relocating home buyers, “improving” cities may also offer better long-term employment and income opportunities.

33 states are represented in the September Improving Market Index, as well as the District of Columbia. 31 new areas were added to the list as compared to August and just 12 dropped off.

The newly-added areas include Sacramento, California; Jacksonville, Florida; and Waco, Texas. Cities falling off the list for September include Dover, Delaware.

The complete Improving Markets Index is available for download at the NAHB website. For a better gauge of what’s happening in Minneapolis on a local level, however, talk to a local real estate agent.

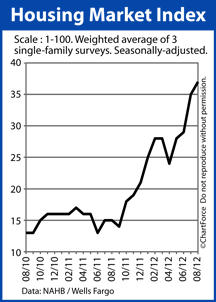

Home builder confidence rises again.

Home builder confidence rises again.